ABSD Measures

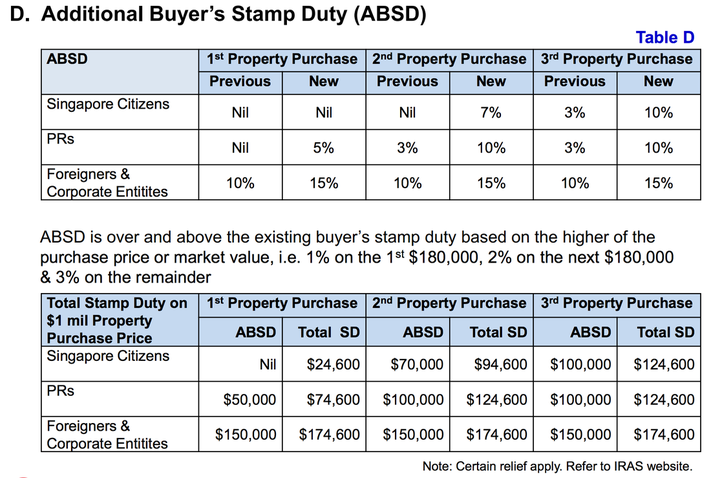

In fact, most of the ABSD updates can be reference from IRAS, but what we have done here is to build a reference to the IRAS website, as well as to provide a chart for an easy understanding, as shown below:

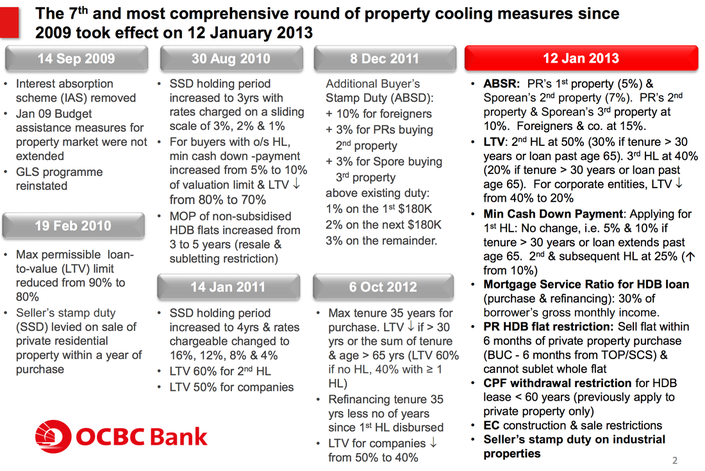

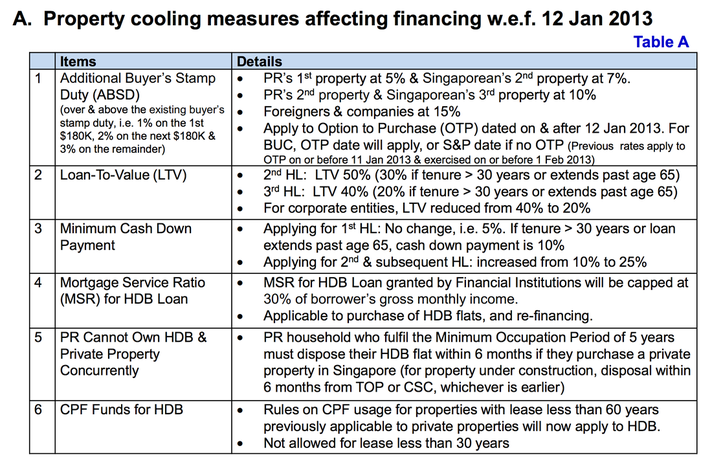

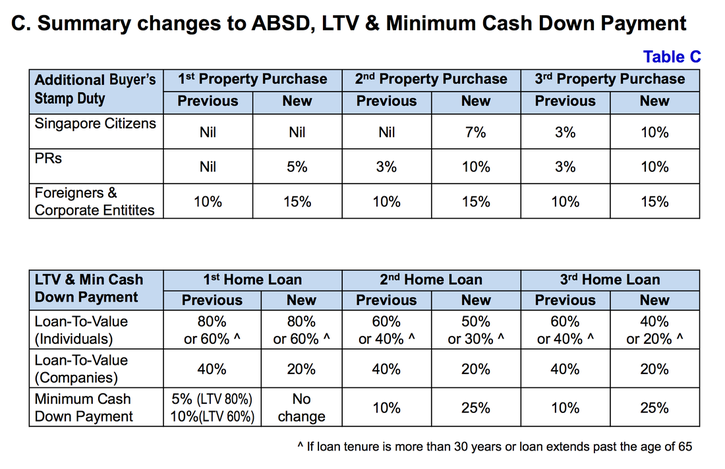

On 7 December 2011, the Government announced the introduction of the Additional Buyer’s Stamp Duty (ABSD) to be paid by certain groups of people who buy or acquire residential properties (including residential land) on or after 8 Dec 2011. On 11 Jan 2013, the Government announced the revised ABSD rates applicable to purchases or acquisitions of residential properties on or after 12 Jan 2013. Affected buyers are required to pay ABSD on top of the existing Buyer’s Stamp Duty (BSD).

On 7 December 2011, the Government announced the introduction of the Additional Buyer’s Stamp Duty (ABSD) to be paid by certain groups of people who buy or acquire residential properties (including residential land) on or after 8 Dec 2011. On 11 Jan 2013, the Government announced the revised ABSD rates applicable to purchases or acquisitions of residential properties on or after 12 Jan 2013. Affected buyers are required to pay ABSD on top of the existing Buyer’s Stamp Duty (BSD).

Affected Buyers & ABSD Rates

Between 8 Dec 2011 and 11 Jan 2013 (both dates inclusive), buyers or transferees who are :

a) Foreigners (FR) and entities* would have to pay ABSD of 10% on the purchase or acquisition of any residential property.

b) Singapore Permanent Residents (SPR) who already own# 1 or more residential properties would have to pay ABSD of 3% on the purchase or acquisition of another residential property.

c) Singapore Citizens (SC) who already own# 2 or more residential properties would have to pay ABSD of 3% on the purchase or acquisition of another residential property.

From 12 Jan 2013, buyers or transferees who are :

a) FR and entities* would have to pay ABSD of 15% on the purchase or acquisition of any residential property.

b)(i) SPR would have to pay ABSD of 5% on the purchase or acquisition of their first residential property.

(ii) SPR who already own# 1 or more residential properties would have to pay ABSD of 10% on the purchase or acquisition of another residential property.

c)(i) SC who already own# one residential property would have to pay ABSD of 7% on the purchase or acquisition of the second residential property.

c)(ii) SC who already own# two or more residential properties would have to pay ABSD of 10% on the purchase or acquisition of another residential property.

# Whether owned wholly, partially or jointly with others.

* Entity means a person who is not an individual, and includes an unincorporated association, a trustee for a collective investment scheme when acting in that capacity, a trustee-manager for a business trust when acting in that capacity and, in a case where the property conveyed, transferred or assigned is to be held as partnership property, the partners of the partnership whether or not any of them is an individual.

The ABSD is payable by affected buyers at fixed rates on the actual price paid or market value of the property whichever is the higher.

BSD continues to be payable by all property buyers at unchanged rates.

Effective Date of ABSD

The old ABSD rates apply to Contracts or Agreements (whichever is earlier), or Documents of Transfer*, dated on or after 8 December 2011, but before 12 Jan 2013.

The new ABSD rates will apply to Contracts or Agreements (whichever is earlier), or Documents of Transfer*, dated on or after 12 Jan 2013.

Where an Option To Purchase has been granted on and before 11 Jan 2013 and exercised thereafter on or before 1 Feb 2013 without any extension of the option validity period, the old ABSD rates may apply subject to approval for remission by IRAS (see Remission/ Refund).

(Source: Mister Exam)

Between 8 Dec 2011 and 11 Jan 2013 (both dates inclusive), buyers or transferees who are :

a) Foreigners (FR) and entities* would have to pay ABSD of 10% on the purchase or acquisition of any residential property.

b) Singapore Permanent Residents (SPR) who already own# 1 or more residential properties would have to pay ABSD of 3% on the purchase or acquisition of another residential property.

c) Singapore Citizens (SC) who already own# 2 or more residential properties would have to pay ABSD of 3% on the purchase or acquisition of another residential property.

From 12 Jan 2013, buyers or transferees who are :

a) FR and entities* would have to pay ABSD of 15% on the purchase or acquisition of any residential property.

b)(i) SPR would have to pay ABSD of 5% on the purchase or acquisition of their first residential property.

(ii) SPR who already own# 1 or more residential properties would have to pay ABSD of 10% on the purchase or acquisition of another residential property.

c)(i) SC who already own# one residential property would have to pay ABSD of 7% on the purchase or acquisition of the second residential property.

c)(ii) SC who already own# two or more residential properties would have to pay ABSD of 10% on the purchase or acquisition of another residential property.

# Whether owned wholly, partially or jointly with others.

* Entity means a person who is not an individual, and includes an unincorporated association, a trustee for a collective investment scheme when acting in that capacity, a trustee-manager for a business trust when acting in that capacity and, in a case where the property conveyed, transferred or assigned is to be held as partnership property, the partners of the partnership whether or not any of them is an individual.

The ABSD is payable by affected buyers at fixed rates on the actual price paid or market value of the property whichever is the higher.

BSD continues to be payable by all property buyers at unchanged rates.

Effective Date of ABSD

The old ABSD rates apply to Contracts or Agreements (whichever is earlier), or Documents of Transfer*, dated on or after 8 December 2011, but before 12 Jan 2013.

The new ABSD rates will apply to Contracts or Agreements (whichever is earlier), or Documents of Transfer*, dated on or after 12 Jan 2013.

Where an Option To Purchase has been granted on and before 11 Jan 2013 and exercised thereafter on or before 1 Feb 2013 without any extension of the option validity period, the old ABSD rates may apply subject to approval for remission by IRAS (see Remission/ Refund).

(Source: Mister Exam)